Budget 2023 acknowledges financial difficulties facing cannabis industry

The sustainability and diversity of Canada’s legal cannabis industry hangs in the balance as Budget 2023 fails to deliver for beleaguered industry.

Ottawa, ON, March 28, 2023 – As the national representative of licensed producers and processors of cannabis, the Cannabis Council of Canada (“C3”) acknowledges Budget 2023’s changes to the cannabis excise duty payment terms from monthly to quarterly. While Budget 2023 notes the financial challenges facing the legal cannabis industry, the measure announced today fails to address the financial viability crisis facing Canada’s legal cannabis industry.

“Almost five years ago, the Trudeau government led the way and created a regulated adult-use cannabis sector that Canadians have widely accepted. This historic decision has also met with acclaim from our provincial and federal governments who reap the rewards, but it’s been a commercial failure for cannabis producers and processors,” noted George Smitherman, C3’s President and CEO. “Canada has built a diverse cannabis sector bringing jobs and renewal to small towns and rural communities across Canada. The survival of our industry’s small and medium sized players hangs in the balance, and the measure announced today and the words acknowledging the challenging conditions that we face don’t add up to meaningful relief,” added Smitherman.

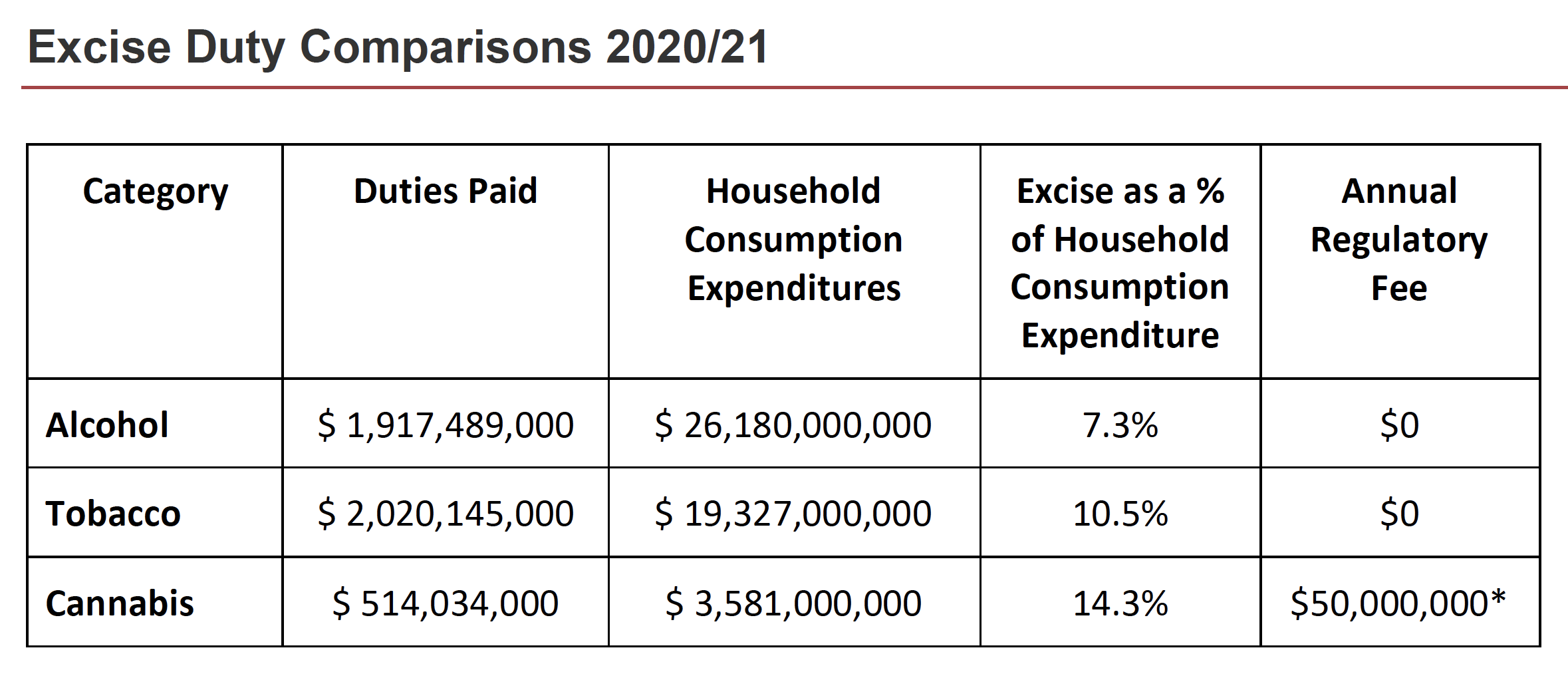

In the 2021/22 fiscal year, governments earned $1.6 billion dollars in revenues (excise tax, sales tax, provincial distributor mark-ups and regulatory fees) from legal cannabis sales. With legal retail sales totaling $4 billion per year, 40% of all revenues from the sale of legal cannabis are going to governments. The cannabis sector’s excise tax rate is 50% higher than that paid by tobacco and two times greater than that paid by the alcohol sector. Unlike tobacco and alcohol, the cannabis sector pays tens of millions of dollars per year in regulatory fees to Health Canada. See chart below:

Sources:

Detailed household final consumption expenditure, Canada, quarterly (x 1,000,000)

Excise Duty Statistical Tables – Fiscal Year 2020-2021

At a March 16, 2023 Newfoundland town hall, commenting on the public health and safety successes of legalization, Prime Minister Trudeau acknowledged that the time had come for the Government of Canada to support the legal cannabis industry. Budget 2023 noted that government will monitor the cannabis sector and work closely with provinces and territories to ensure alignment with the coordinated taxation framework. “We will be pleased when the federal government’s commitment to work on the Excise Tax is reflected in real action. We repeat our call on the Minister of Finance to reform the Excise Tax Framework and to ending the unjust Annual Regulatory Fee paid by federal cannabis licensed producers and processors,” commented Smitherman. “As we approach the fifth anniversary of cannabis legalization and the Fall Economic Statement, C3 is going to broaden its membership of licence holders and make the full court press necessary to get the action our situation warrants. Words are not enough.” concluded Smitherman.

For media inquiries (English)

George Smitherman

President and CEO

Cannabis Council of Canada

george@cannabis-council.ca

For media inquiries (French)

Pierre Killeen

Vice-President, Legislative and Regulatory Affairs

Cannabis Council of Canada

-- 30 --

About the Cannabis Council of Canada

Further Information

For media inquiries

George Smitherman

President and CEO

Cannabis Council of Canada

george@cannabis-council.ca