Shape the Future of the Excise Tax Framework

The Department of Finance is seeking more data from LPs

After bringing our excise tax survey results to Ottawa during the successful Grass on the Hill Summit last month, we’re happy to report the government wants to learn more. The Department of Finance would like to get a deeper understanding of how excise tax impacts License Holders’ financial positions, and how different rate models can help the long-term viability of our sector.

They would like to understand the financial impact on Licence Holders if:

- The excise duty was eliminated altogether

- The $1 per gram was cut in half

- The rate was a set % of the producer's selling price

What would the financial statements look like for a typical year under each scenario? What might those statements look like 3-5 years out?

This is where you come in.

We’re asking Health Canada License Holders who pay excise tax to provide the Canadian government with a confidential look at their financials for 2022. Deadline to respond: November 30, 2023.

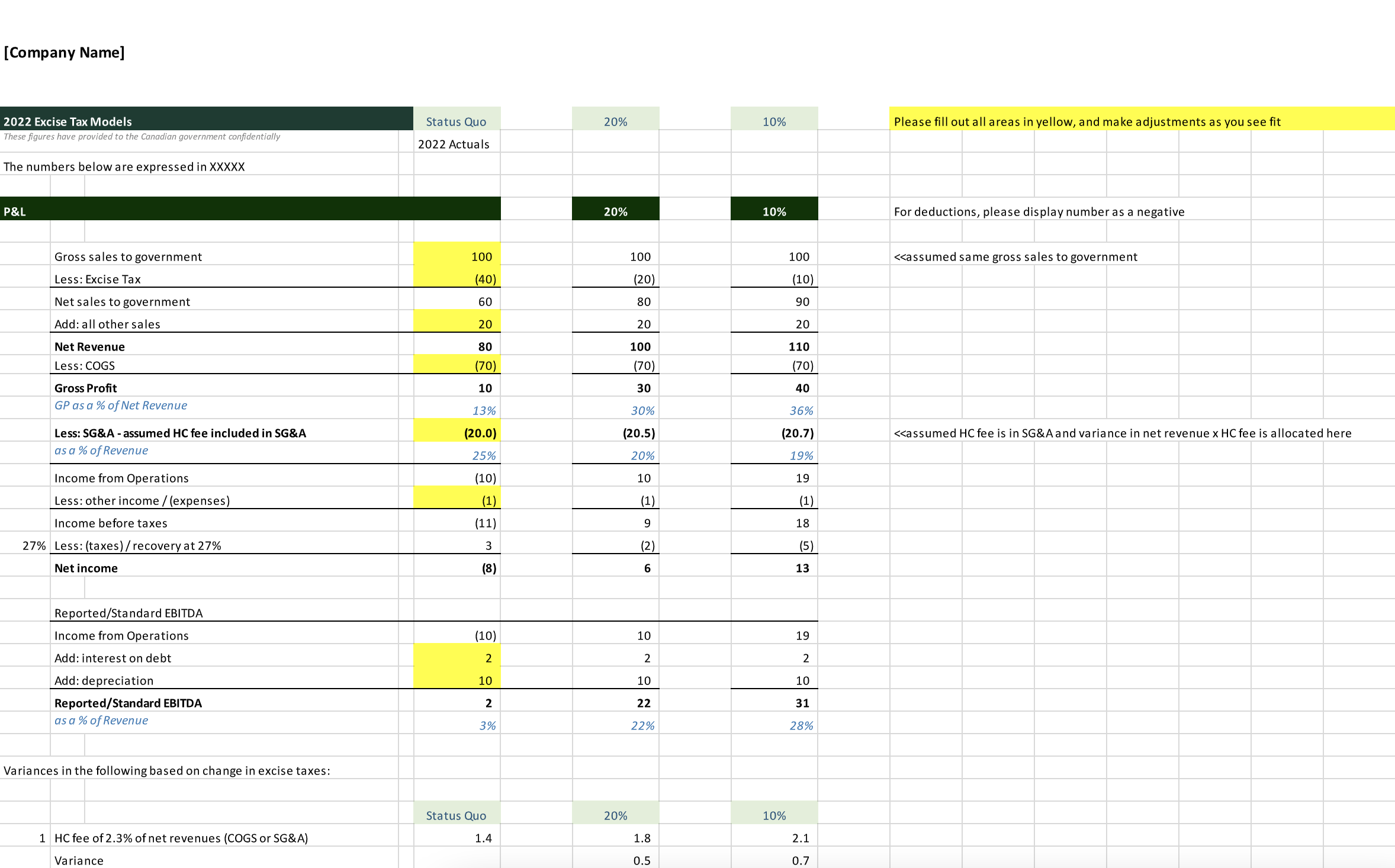

1. Compile your 2022 financials. Our simple Excise Model spreadsheet can be used to compare the status quo vs a set rate of 10% or 20%. Feel free to make any modifications to the template as needed for your business. Your financials will remain 100% confidential and will only be reviewed and used by Canadian government officials to inform updates to the excise duty framework.

2. Make your submission directly to the Department of Finance. We encourage you to call out any particularly challenging excise dynamics you experience across categories (if applicable to you) when making your submission. Reach out to hello@cannabis-council.ca for the correct contact information.

3. Let C3 know you’ve completed your submission via email at hello@cannabis-council.ca. Please don’t share your financial submission with C3 - we want to keep your information private. We’d simply like to know if you’ve participated.

We encourage you to share this opportunity with other Health Canada Licence Holders whose operations might be impacted by a change to the excise tax framework. With your participation, we’ll be able to make changes and establish the conditions to ensure the viability of our industry.

The time to save our sector is now!

Excise Model Template

Download our excel template to compare the status quo vs a 10% or 20% set excise rate.